Murray Math Lines 08.08.2011 (USD/CHF, GPB/CHF, GOLD)

08.08.2011

Analysis for August 8th, 2011

USD/CHF

During the market trading opening there was a gap down. The price moved down far enough from the entry point of sell order, that’s why I’ve moved the stop on the order into the black. The target is still at the -2/8 level. Most likely, the price will continue falling during the day.

The lines were finally redrawn at the H1 chart. Now we have an excellent target at the 0/8 level. It seems like the market is rebounding from H1 Super Trend, thus indicating that the price may continue falling down during the next few hours.

GBP/CHF

The price is still consolidating between the 4/8 and 3/8 levels, the correction is supported by H4 Super Trend. After the price had rebounded from it, I decided to open a sell order with the stop above daily Super Trend and Take Profit at the 0/8 level. The market may reach this target easily during the current week.

At the H1 chart the price may reach the 0/8 level. Taking into consideration the targets on the major time frames, most likely the level will be broken and the price will move even lower. After the market breaks the -2/8 level, the lines will be redrawn.

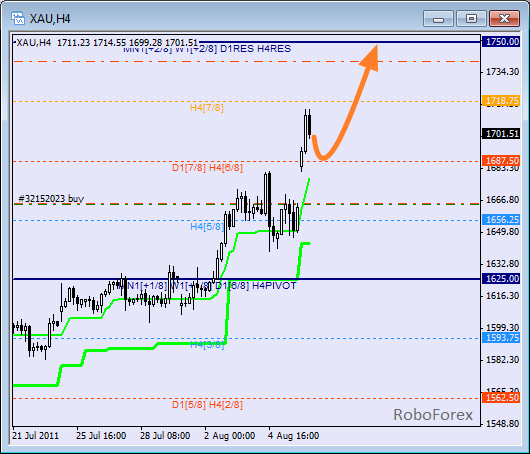

GOLD

In case of GOLD during the market trading opening there was a significant gap up. It allowed me to move the stop on buy order, which I opened last week, into the black. Now the target is the 8/8 level, where Take Profit is. The price may continue growing after a slight correction.

At the H4 chart we can see that the price is being corrected. It’s possible that the price may test either the 4/8 level or H4 Super Trend’s line during the correction. In case the price rebounds from it, there will be a signal for up-trend to continue.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.