Technical Analysis & Forecast 01.04.2024

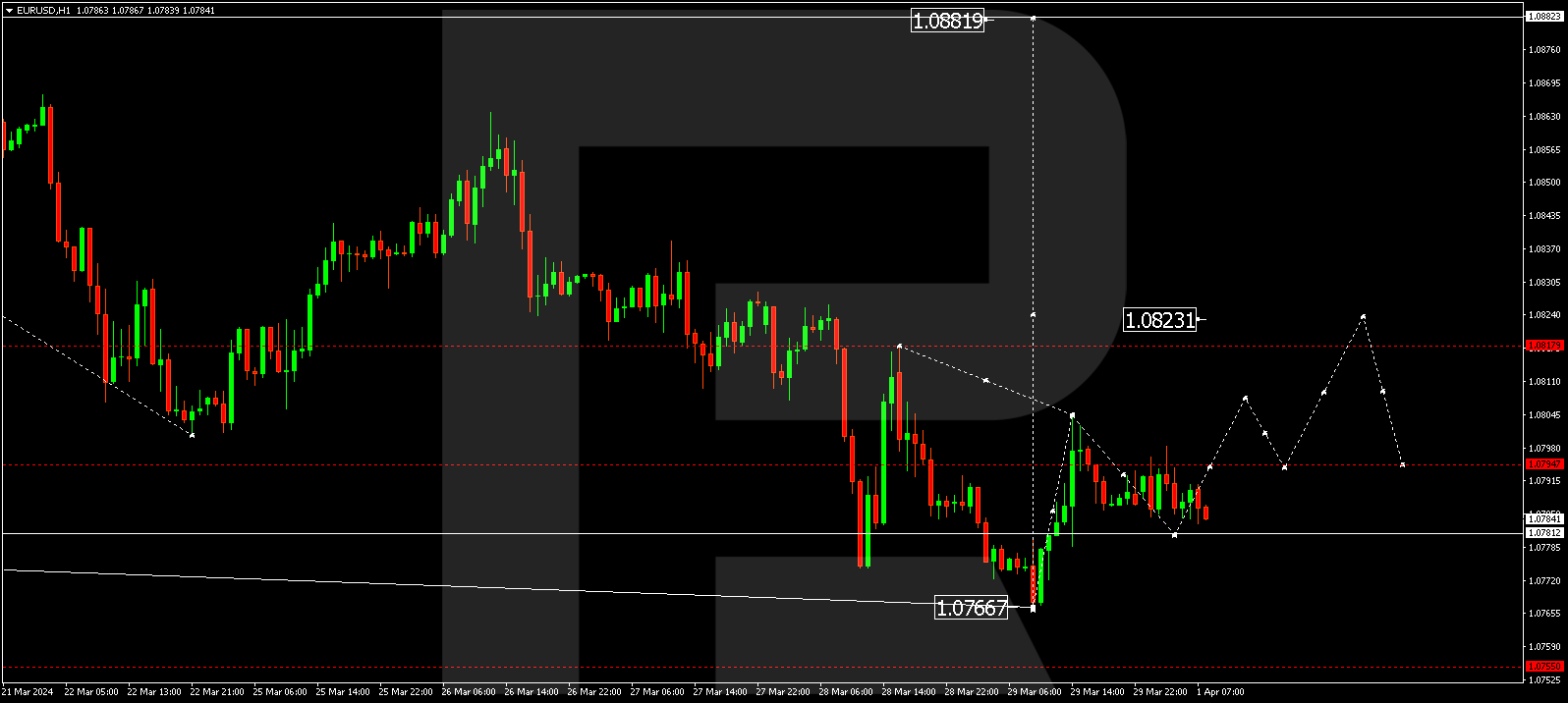

EURUSD, “Euro vs US Dollar”

The EURUSD pair completed a decline wave to 1.0767 and by now has formed a growth impulse to 1.0804. Today the market is correcting towards 1.0781. Practically, the market has set the frames for a consolidation range. With an upward escape from the range, the growth wave might extend to 1.0823. A downward escape could open the potential for a decline wave to 1.0700. This is a local target.

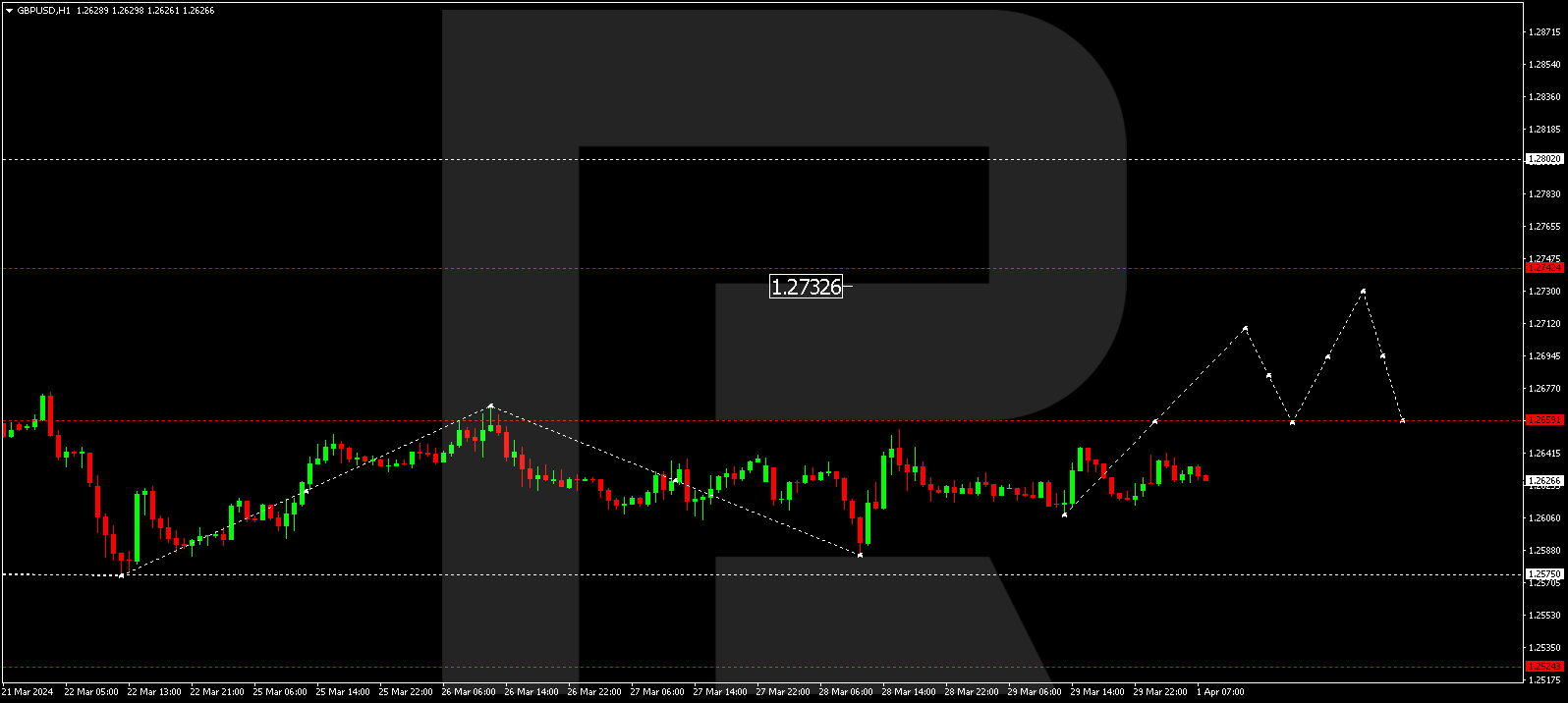

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair continues forming a consolidation range around 1.2620. With an upward escape from the range, the growth wave could continue to 1.2712, from which level the trend might extend towards 1.2730. With a downward escape, the wave could continue to 1.2525.

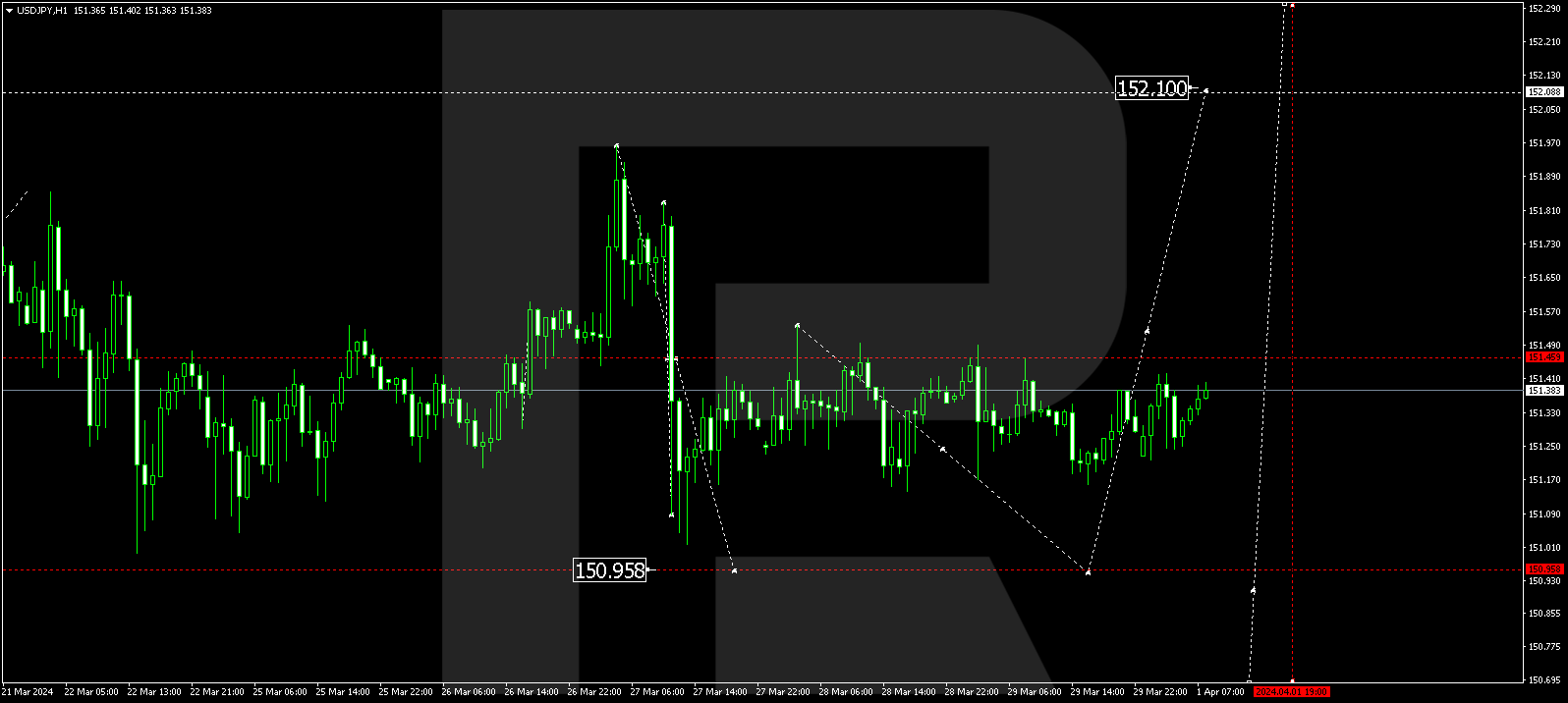

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a consolidation range around 151.45 without any obvious trend. A decline link could develop towards 150.95 today. Next, a growth wave to 151.50 might follow. If this level also breaks upwards, the potential for a wave to 152.00 might open, from which level the trend could extend towards 152.80.

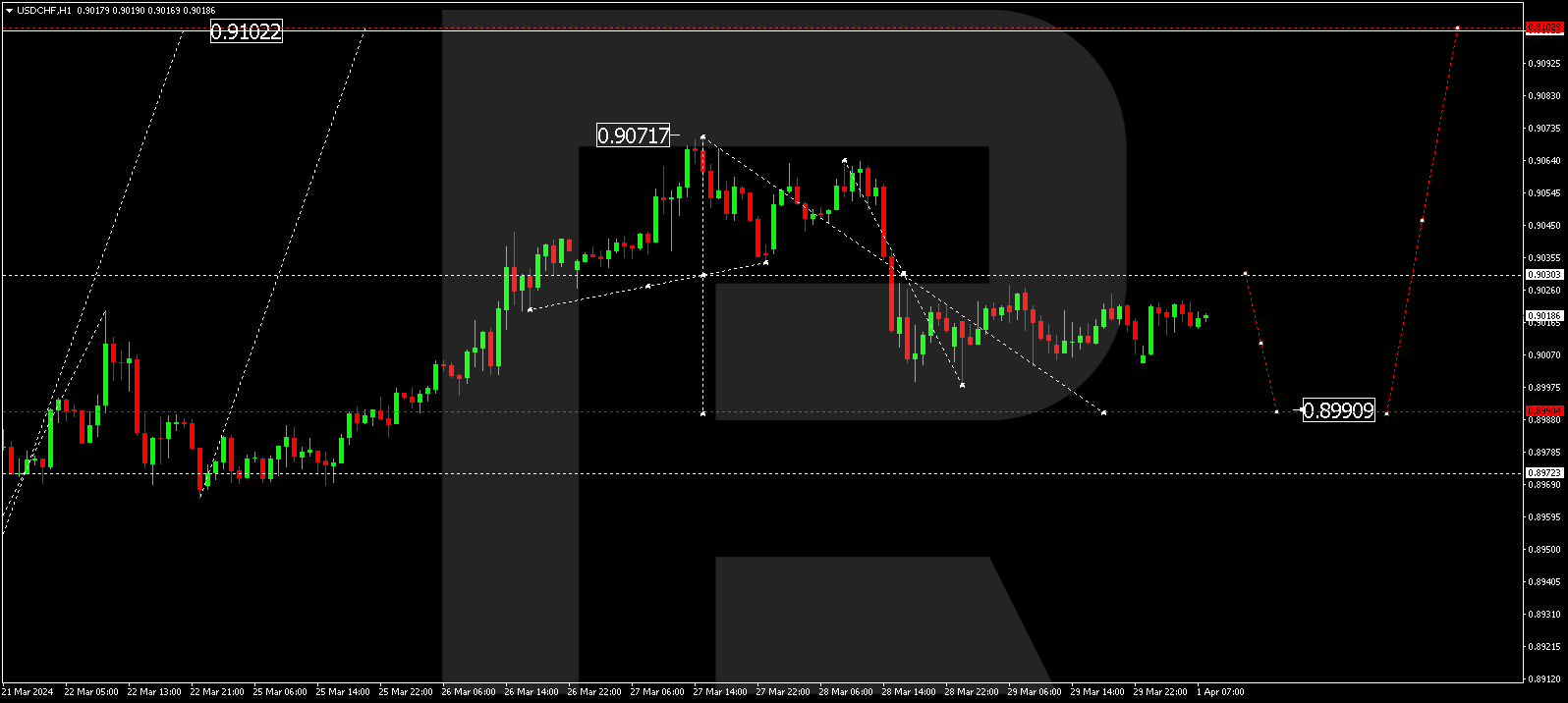

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues developing a consolidation range around 0.9033. A decline link towards 0.8990 is not excluded today. Practically, a correction wave might form. Next, a new growth structure could develop towards 0.9045. And if this level also breaks, the potential for a wave to 0.9100 might open. This is the first target.

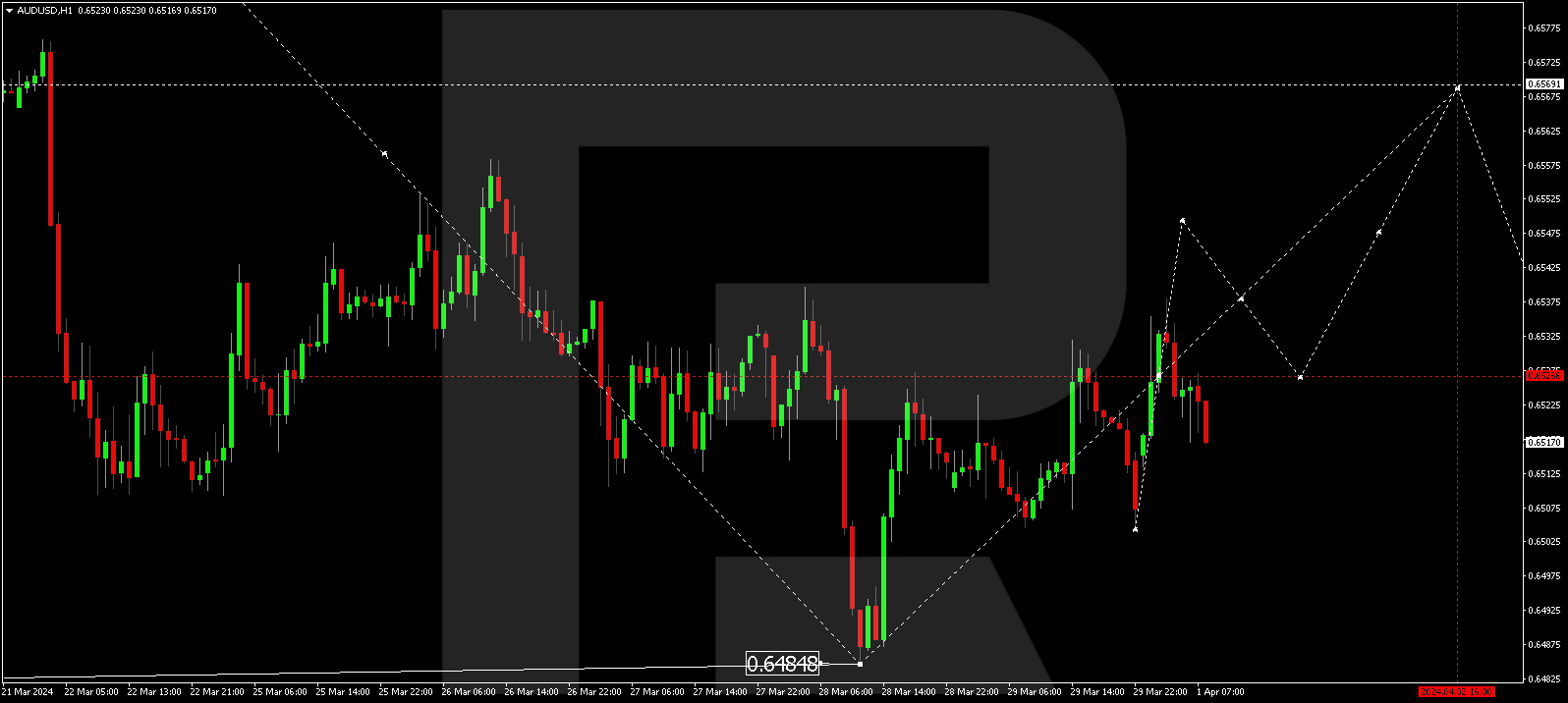

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair continues developing a consolidation range around 0.6505. With an upward escape, a growth link towards 0.6555 might form, from which level the wave could continue to 0.6570. With a downward escape, the potential for a wave towards 0.6484 might open.

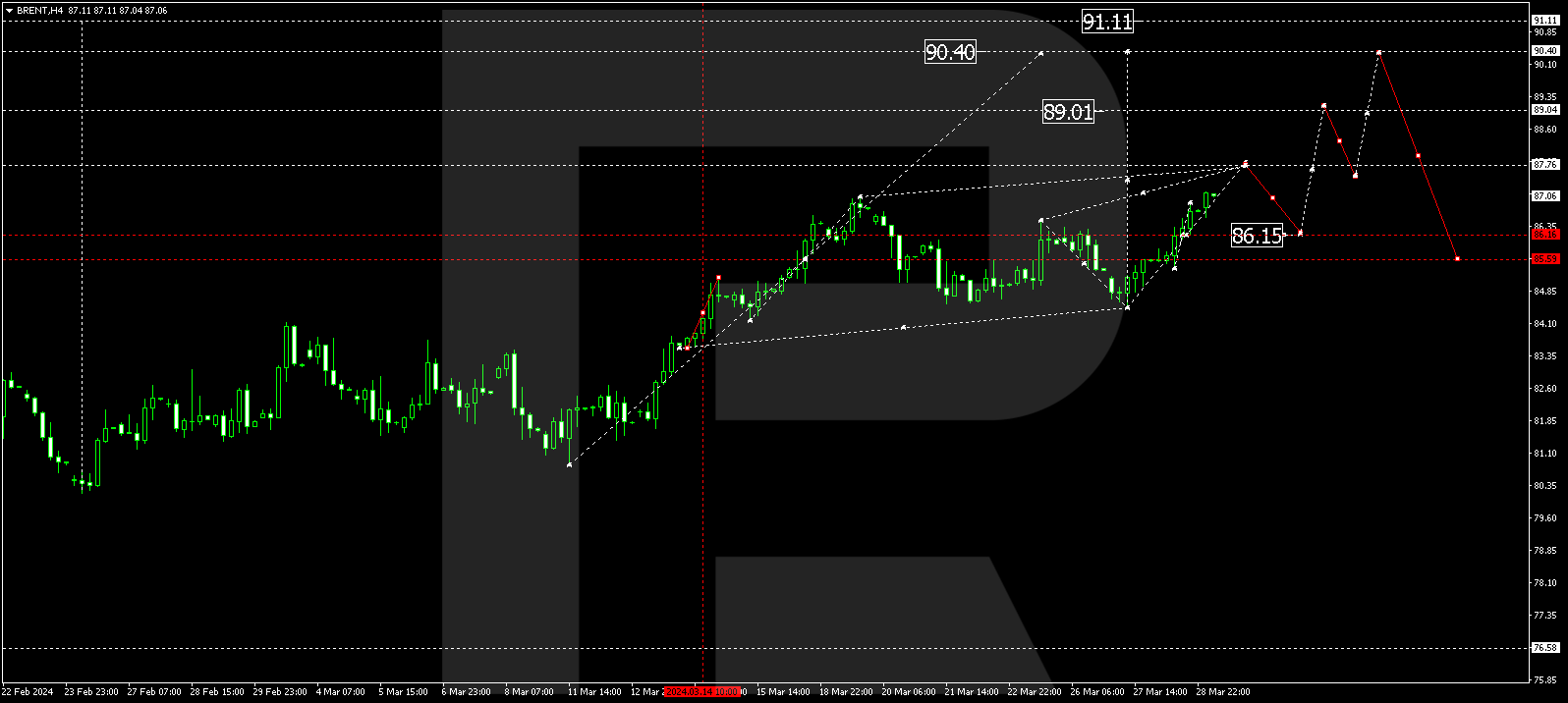

BRENT

Brent has broken the 86.55 level and continues developing the wave towards 87.77. Once this level is reached, a correction link to 86.15 is not excluded. Next, a rise to 89.00 could follow, from where the trend might extend to 90.40. This is a local target.

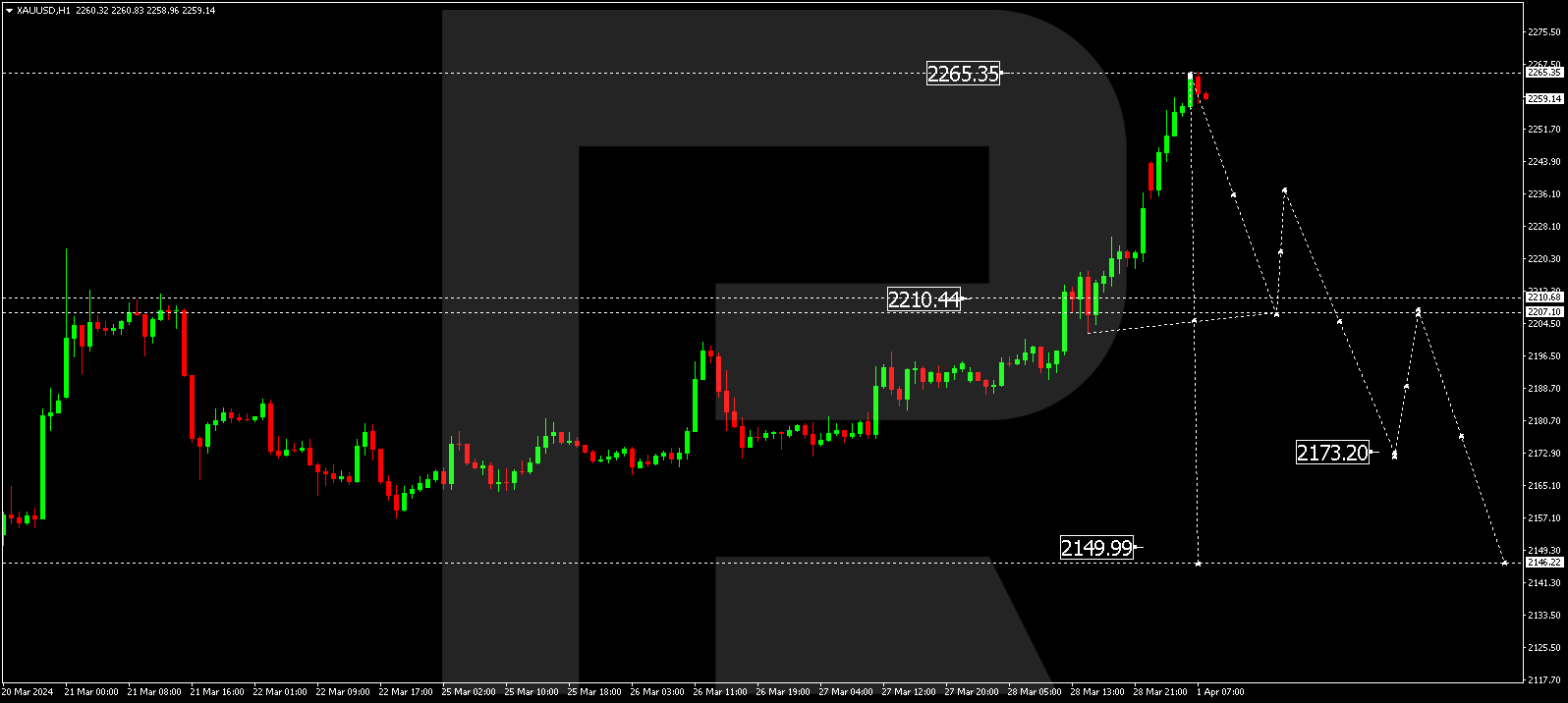

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave towards 2265.35. A consolidation range could form at the top of the growth wave today. With a downward escape, a correction to 2207.00 could begin. This is the first target.

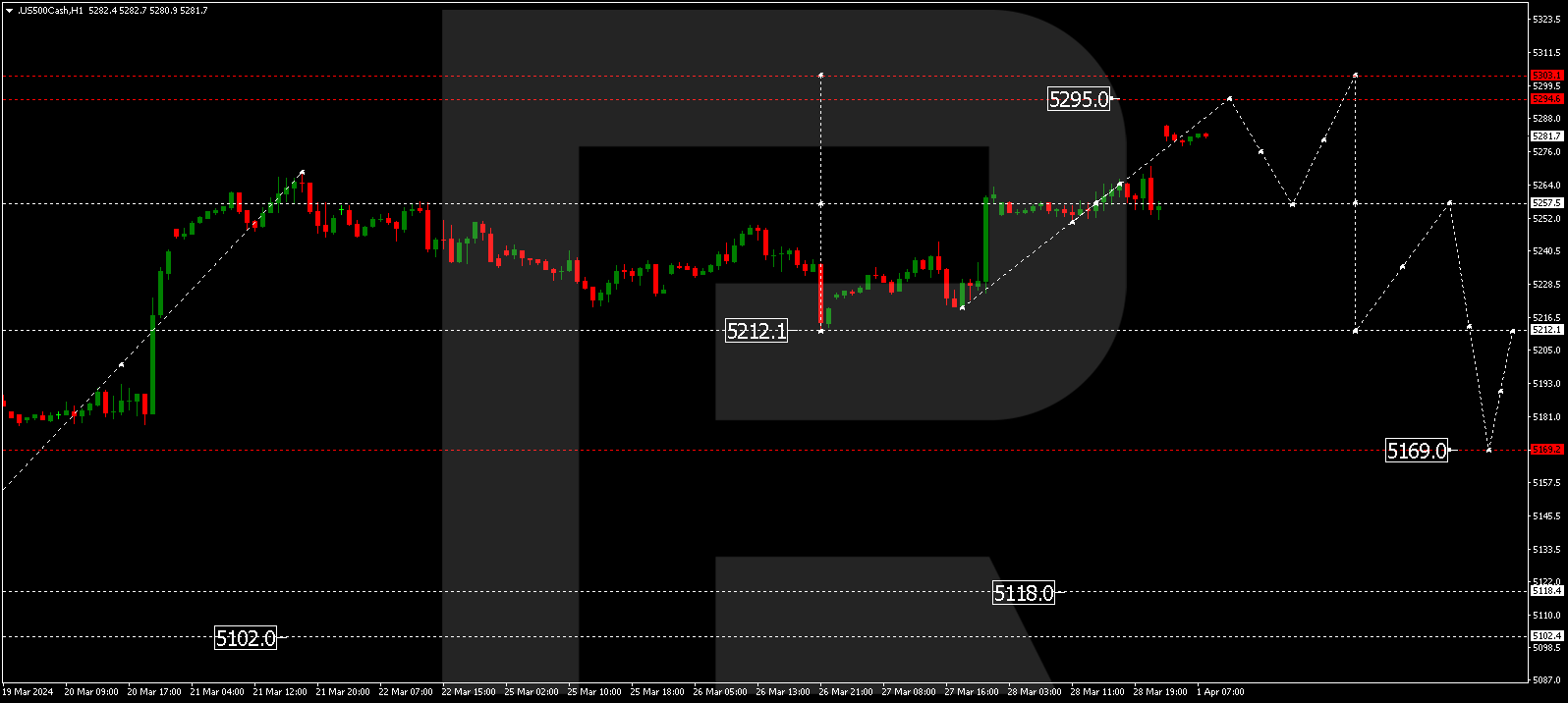

S&P 500

The stock index has broken a consolidation range upwards. By now, the quotes have completed a growth wave to 5285.5. Today the pair might rise to 5295.0. Next, it could drop to 5285.0 (testing from above), after which another growth wave to 5303.0 is not excluded.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.