Fibonacci Retracements Analysis 05.07.2013 (EUR/USD, USD/CHF)

05.07.2013

Analysis for July 5th, 2013

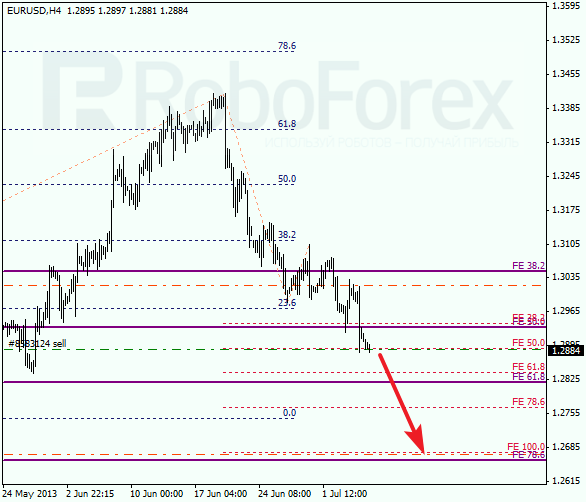

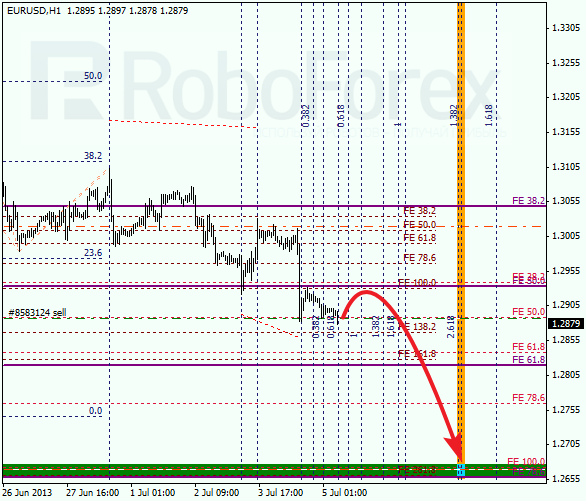

EUR/USD

Euro continues falling down and isn’t likely to make a reverse in the nearest future. It means that the bears should find themselves new targets. We can’t exclude a possibility that the price may reach the level of 78.6% from the descending movement that took place in February and March. The confirming level is the one of 100% (extension) from the latest descending movement.

There is a possibility that Euro may start a correction during the day. The temporary fibo-zones indicate that the Euro may reach the target levels in the beginning of the next week. If the pair rebounds from the level of 78.6%, the price may start a correction.

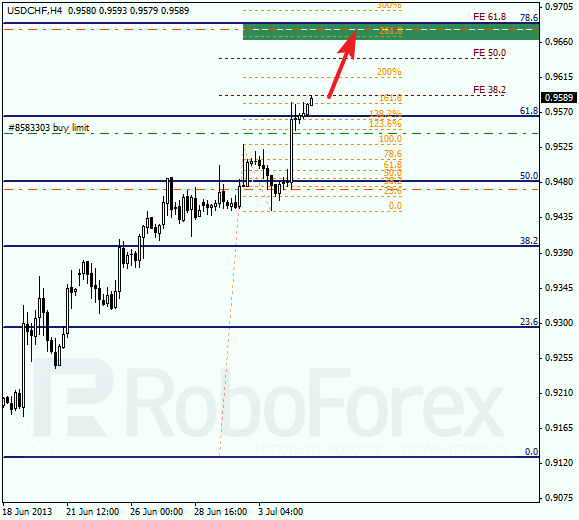

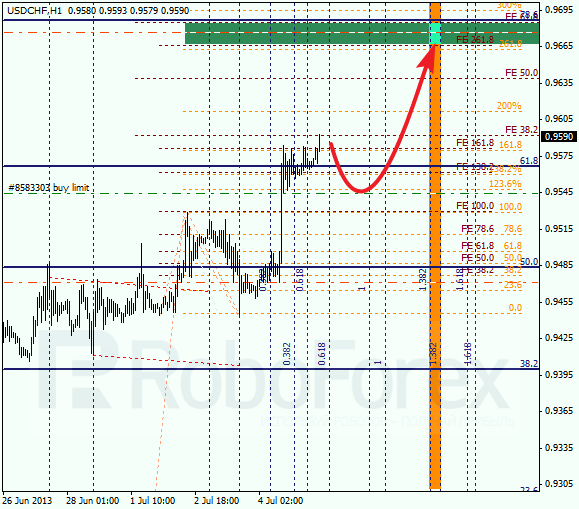

USD/CHF

Franc reached its predicted target at the level of 61.8% and broke it. The next target for the bulls is at the level of 78.6%, where there are several more confirming fibo-levels.

As we can see at the H1 chart, the ascending movement is slowing down. I’m planning to open buy orders during a correction, that’s why I’ve already placed a limit sell order. According to the analysis of the temporary fibo-zones, the upper levels may be reached next Monday or Tuesday.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.