Fibonacci Retracements Analysis 07.11.2014 (EUR/USD, USD/CHF)

07.11.2014

Analysis for November 7th, 2014

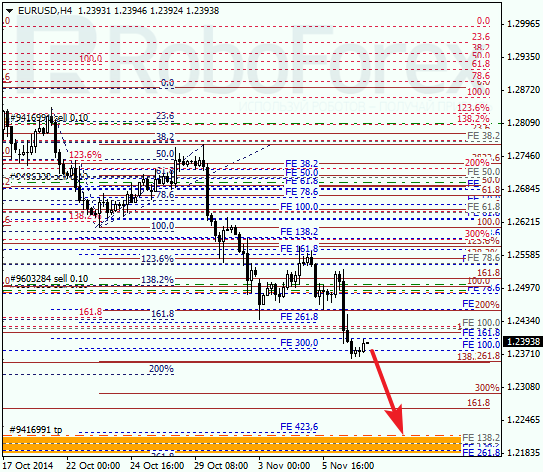

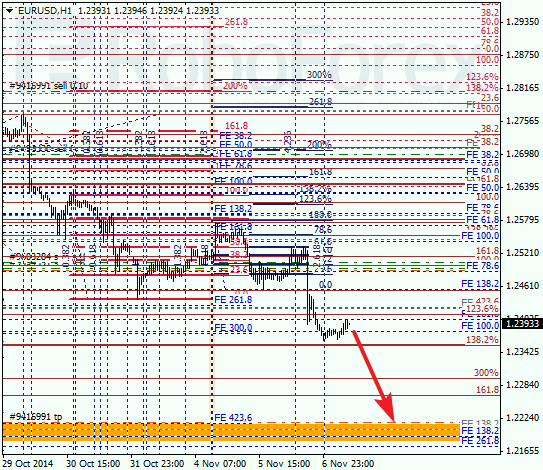

EUR USD, “Euro vs US Dollar”

Yesterday Eurodollar resumed falling and reached a new low. Earlier, I’d decided to change the target for my sell order; now it’s the group of lower fibo-levels at 1.2215 – 1.2190. The stop losses on all my orders have been moved to the level where the last ones were opened.

At the H1 chart, temporary fibo-zones indicate that a local correction has completed at retracement 78.6%. The main predicted targets are confirmed by several local retracements. Considering that the pair has rebounded from a local retracement 61.8%, the market is expected to reach the lower target area during the next several hours.

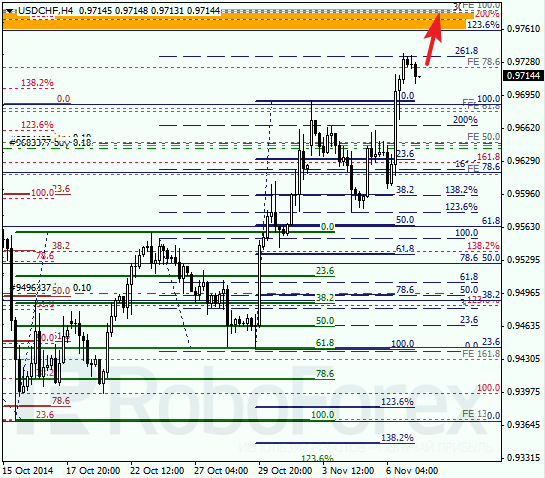

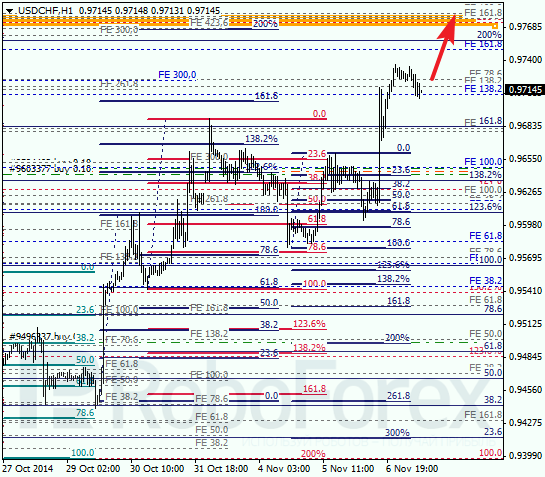

USD CHF, “US Dollar vs Swiss Franc”

Franc has successfully left its consolidation range and broken a local high. Earlier this week the price rebounded from retracement 38.2% and resumed growing. The target for buyers is the group of upper fibo-levels.

At the H1 chart, the upper targets are confirmed by several local retracements. During this correction, I’ve already opened two additional buy orders. If the pair rebounds from the upper levels, the market may start a serious pullback downwards.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.