Forex Technical Analysis 24.07.2013 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, GOLD)

24.07.2013

Analysis for July 24th, 2013

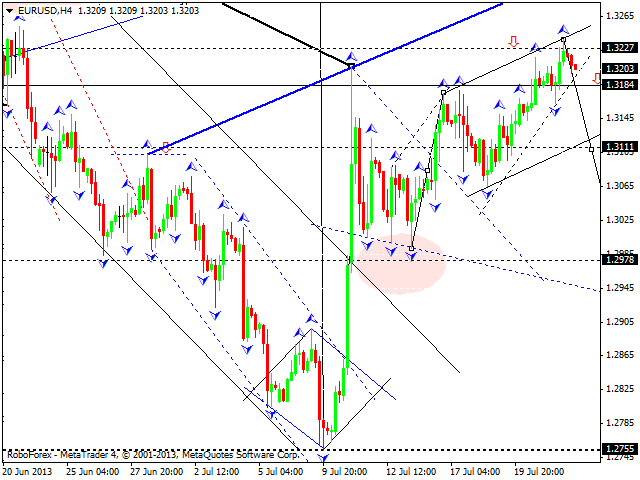

EUR/USD

Euro is extending the current ascending structure; this movement may be considered as a correction. We think, today the price may form a new descending structure to reach the level of 1.2990. The pair is expected to form a five-wave structure, which may be considered as a classic wave C.

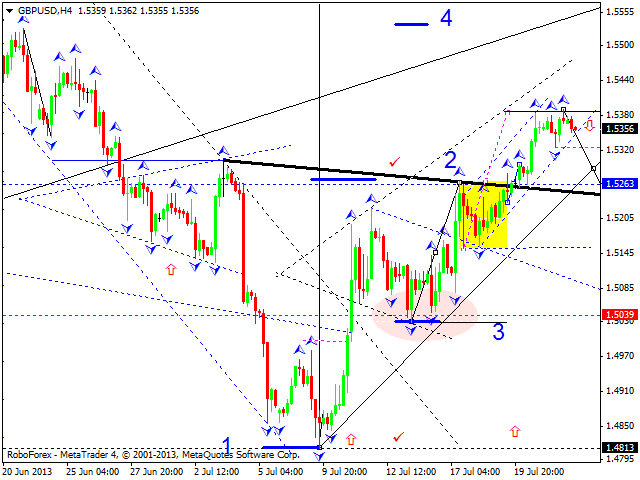

GBP/USD

Pound is starting a new descending structure. We think, today the price may continue its correction towards the level of 1.5040 and then start forming another ascending wave.

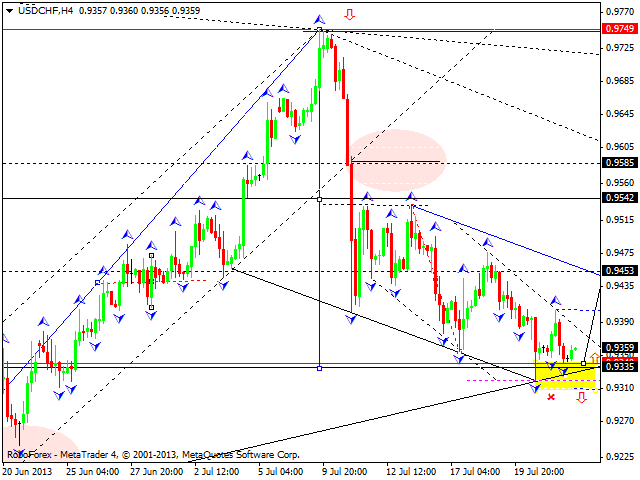

USD/CHF

Franc is starting a new ascending structure to return to the level of 0.9590; the market has already formed the first impulse and a consolidation channel. We think, today the price may leave this channel upwards and then start another ascending structure to complete this correction.

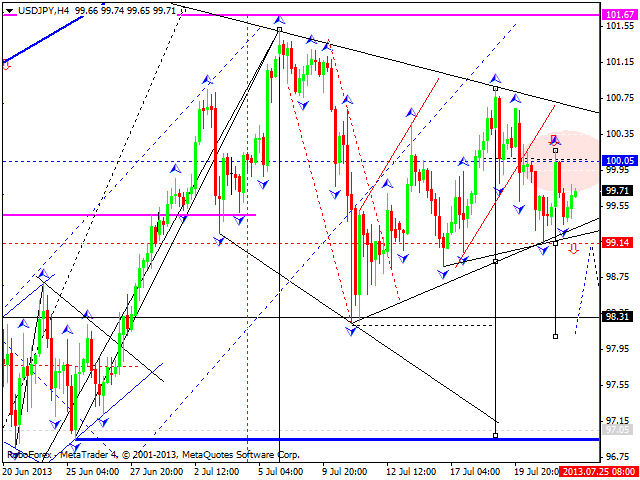

USD/JPY

The USD/JPY currency pair completed a descending wave and formed a consolidation channel. We think, today the price may continue moving downwards and break the channel’s lower border. The next target is at 98.30. Later, in our opinion, the pair may consolidate for a while and then continue falling down towards the target at 97.00.

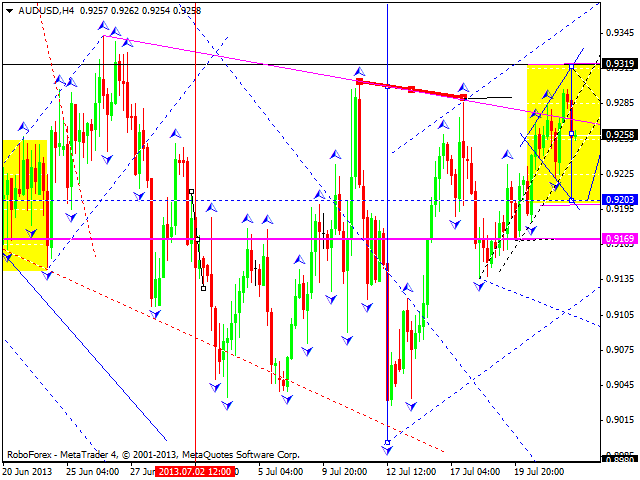

AUD/USD

Australian Dollar renewed the top of the first wave and is trying to form a continuation pattern at the new maximums. This trading range may be considered as diamond pattern. If the pair breaks the pattern upwards, the price will reach the level of 0.9400; if downwards – it will continue falling down.

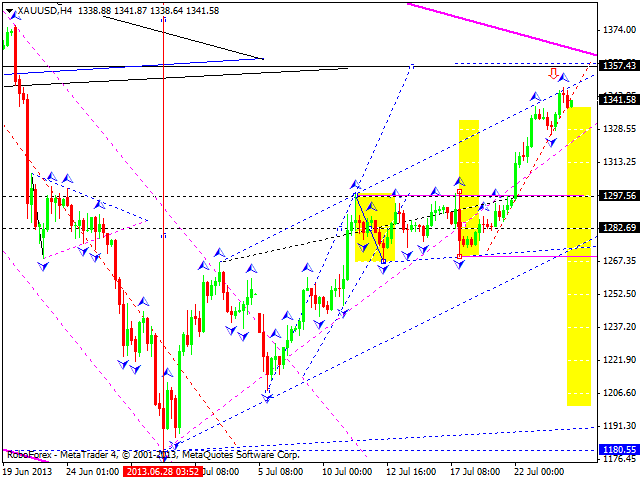

GOLD

Gold is forming a wave with the target at 1355. Later, in our opinion, the price may start a correction towards the level of 1295, form a new ascending structure to reach the target at 1385, and then continue falling down.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.