Fibonacci Retracements Analysis 29.10.2020 (AUDUSD, USDCAD)

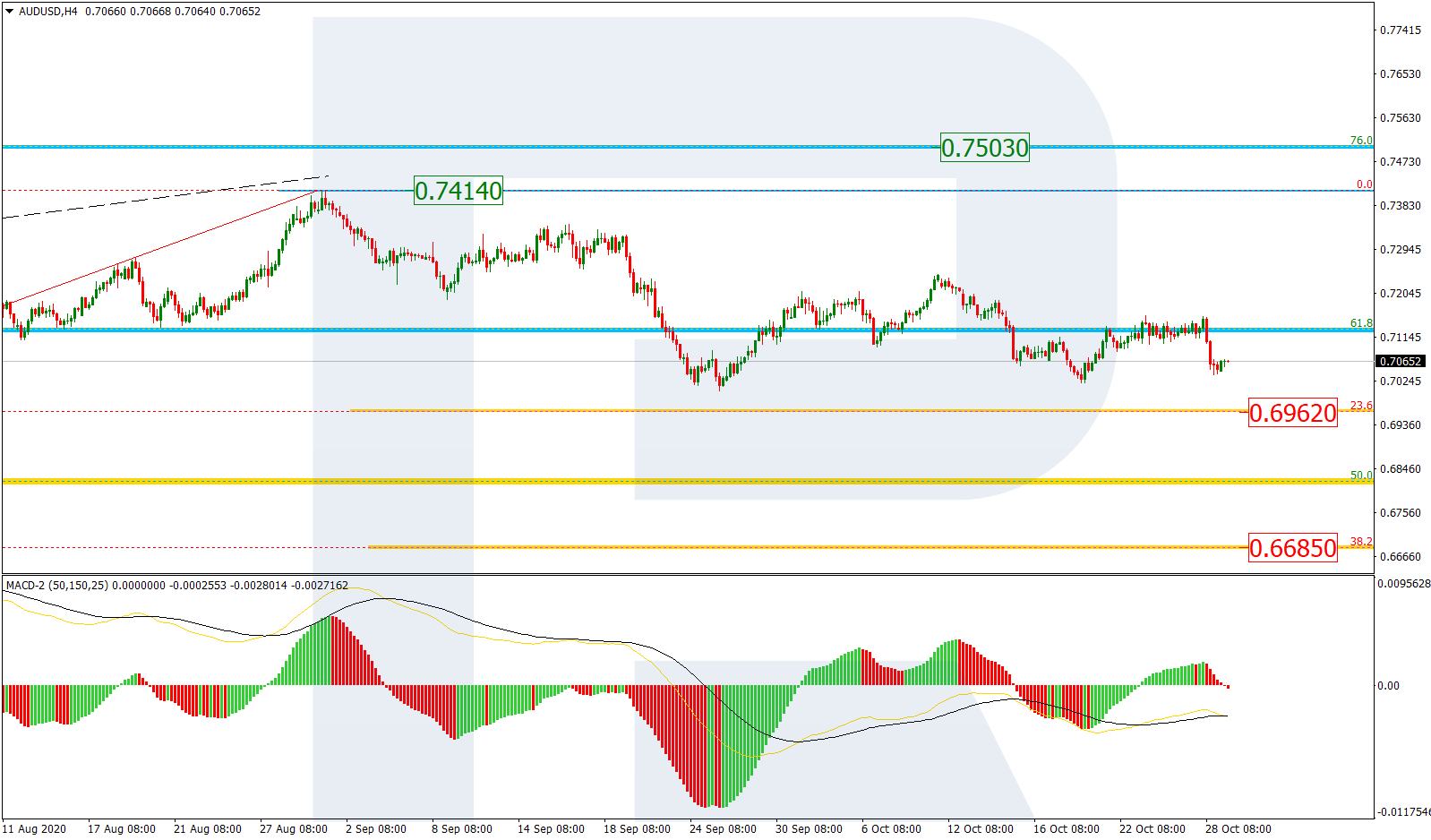

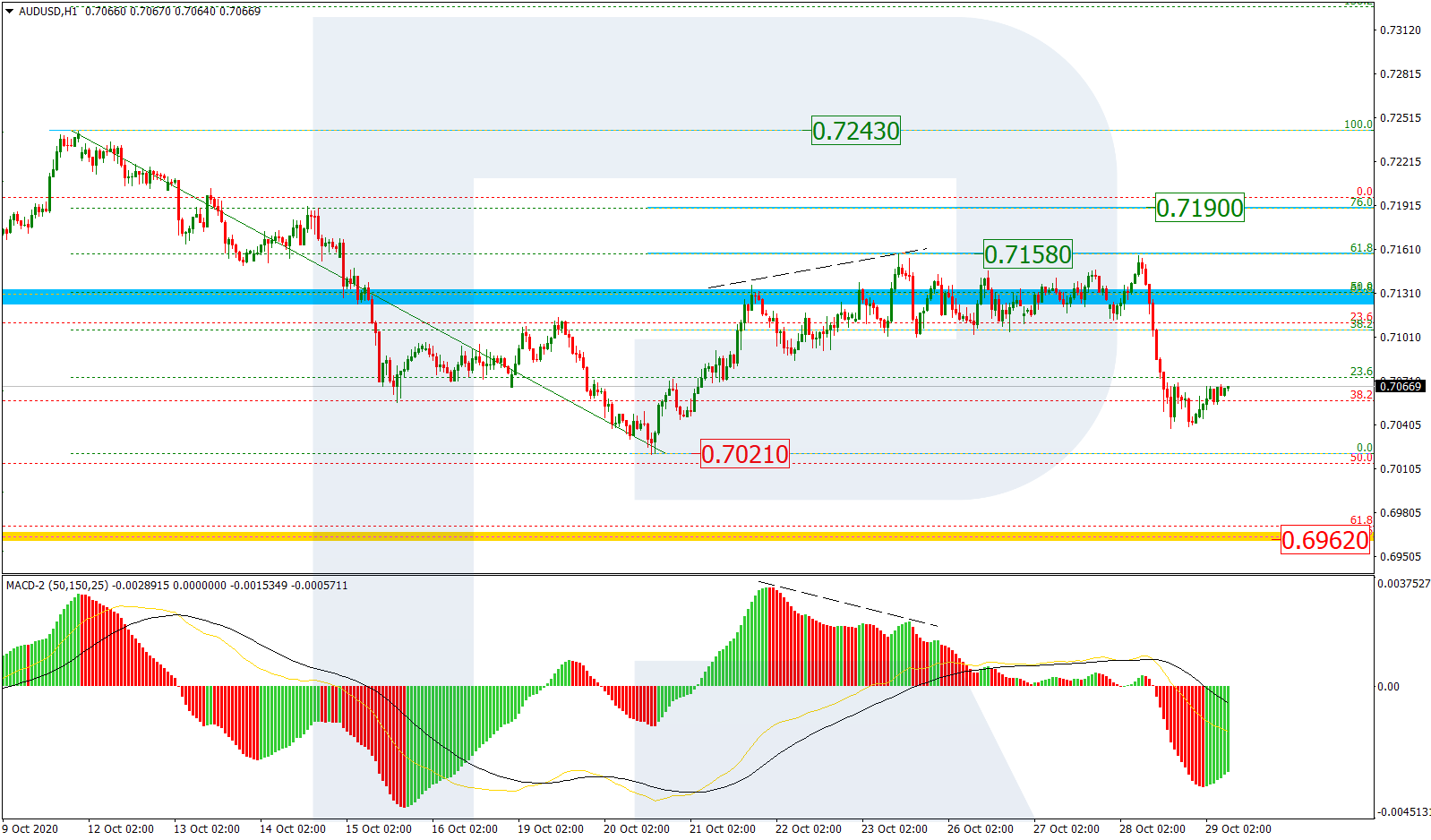

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the mid-term technical picture hasn’t changed much: the asset is still moving within a narrow range above 23.6% fibo. In this case, there are two equally possible scenarios (bullish – a growth towards the high at 0.7414, and bearish – further decline to reach 23.6% and 38.2% fibo at 0.6962 and 0.6685 respectively). In the case of the first scenario, the instrument may break the high at 0.7414 and then reach the long-term 76.0% fibo at 0.7504. However, a quick descending impulse formed recently may indicate that bears are much stronger and start a proper descending tendency pretty soon.

The H1 chart shows that the pair has plunged after a tight test of 61.8% fibo at 0.7158. As long as the price is moving above the low at 0.7021, there is a possibility that the asset resume trading upwards to reach 76.0% fibo at 0.7190, as well as the high at 0.7243. However, a breakout of the low at 0.7021 may lead to further decline towards the mid-term 23.6% fibo at 0.6962.

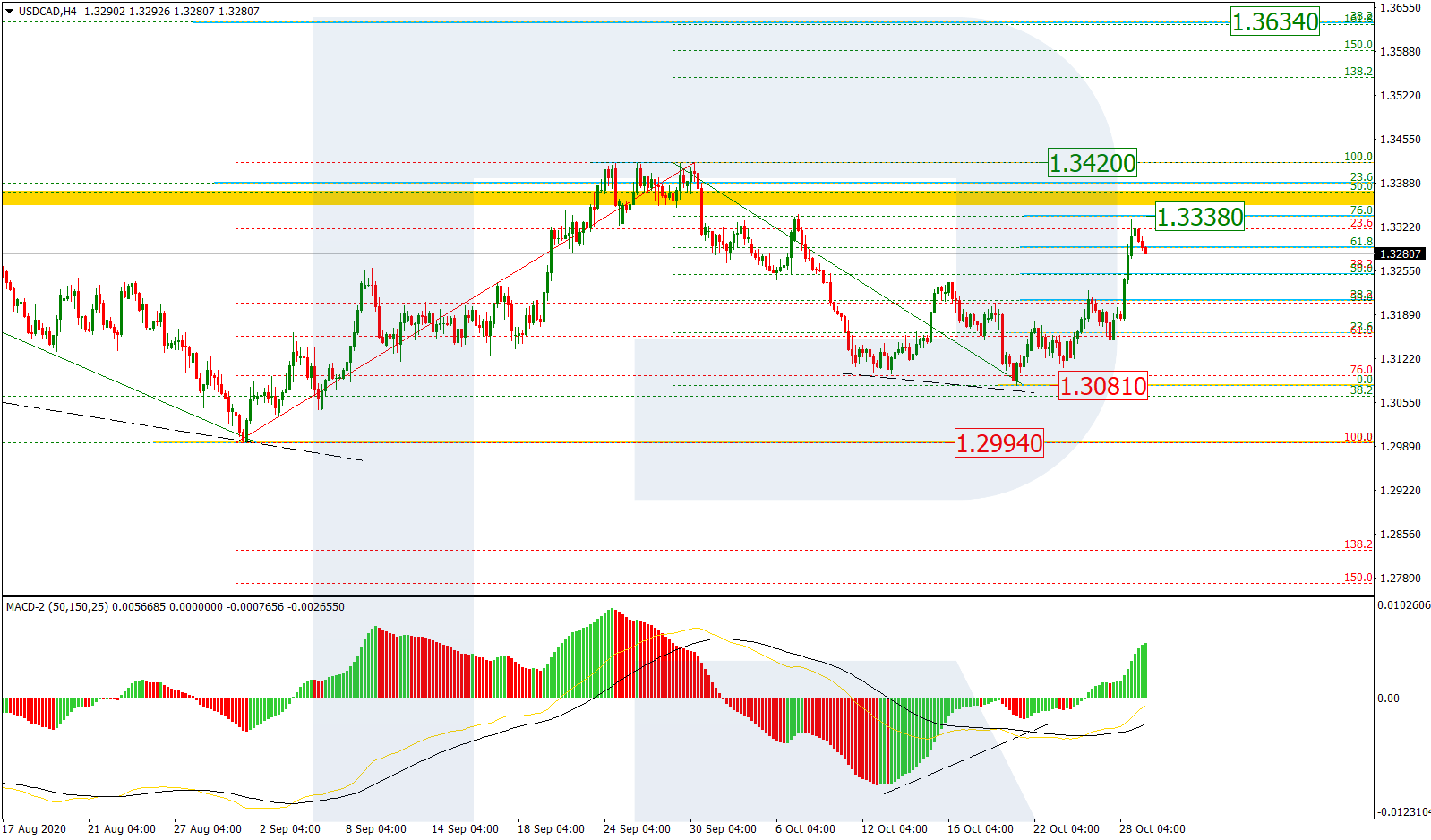

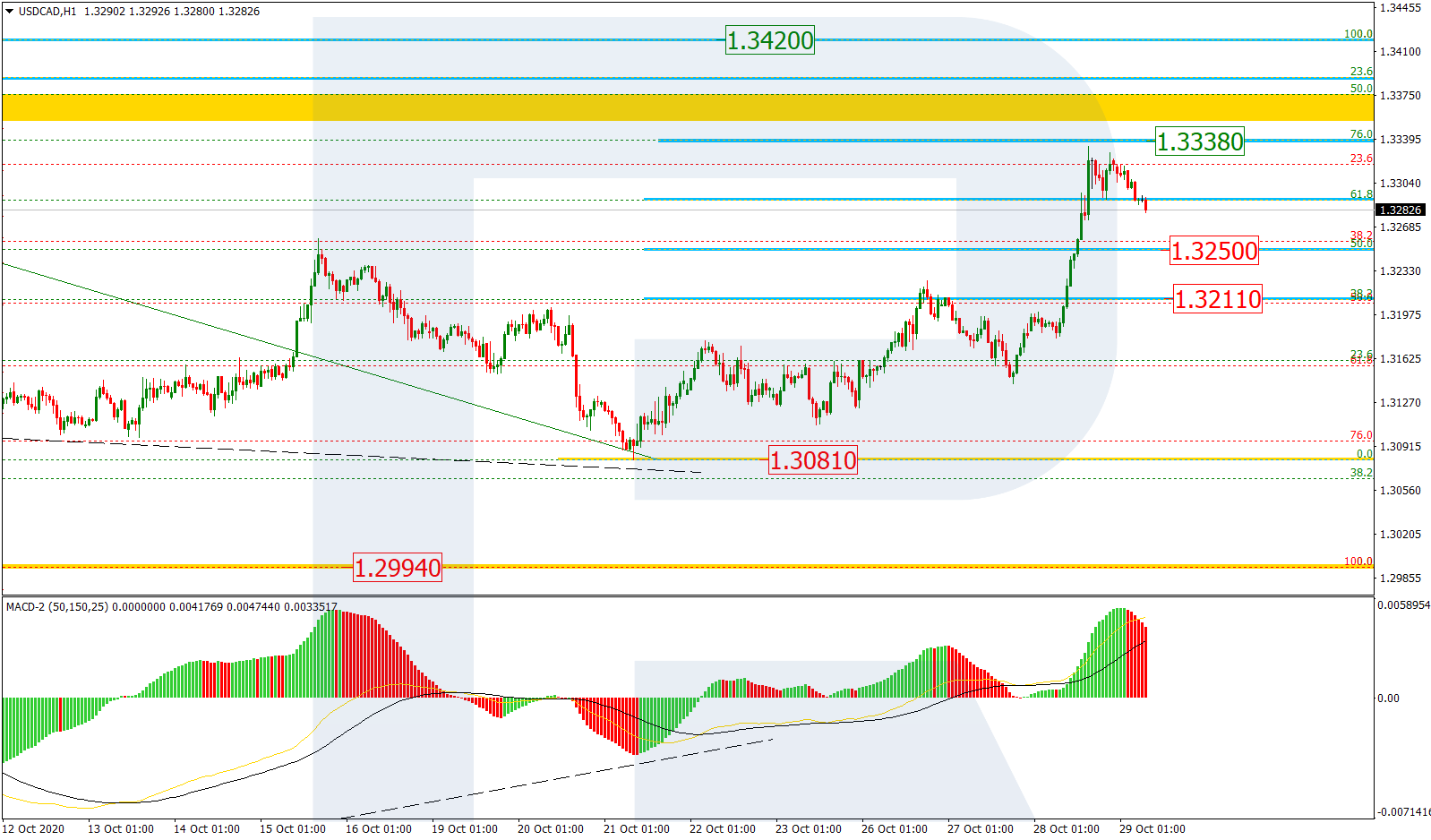

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, USDCAD is moving upwards steadily after a convergence on MACD and has already reached 61.8% fibo. The main scenario implies further growth to break the high 1.3420. After that, the instrument may continue the ascending tendency towards the long-term 38.2% fibo at 1.3634. However, an alternative scenario says that the asset may break the low at 1.1.3081 and then continue falling towards the fractal low at 1.2994.

In the H1 chart, after reaching 61.8% fibo and attempting to test 76.0% fibo, the asset has started a new pullback. The correctional targets are at 1.3250 and 1.3211. Later, the market may resume the uptrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.