Ichimoku Cloud Analysis 09.04.2021 (USDJPY, AUDNZD, USDCHF)

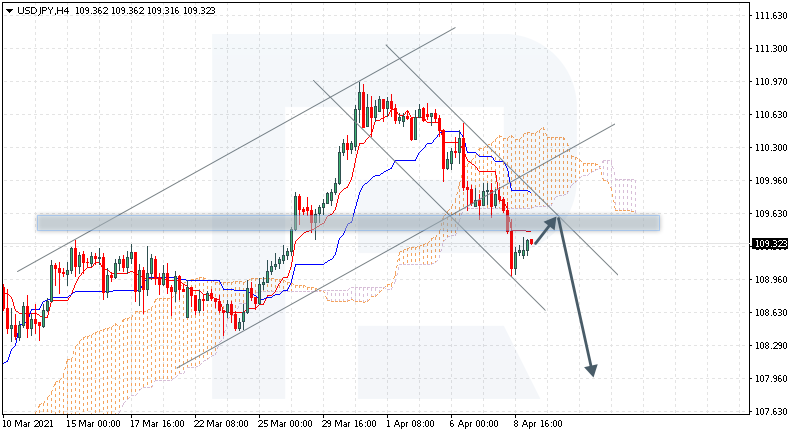

USDJPY, “US Dollar vs Japanese Yen”

The currency pair is trading at 109.32 under the Ichimoku Cloud, suggesting a downtrend. A test of the signal lines of the indicator at 109.55 is expected, followed by falling to 107.95. An additional signal confirming the decline might become a bounce off the upper border of the descending channel. The scenario can be canceled by a breakaway of the upper border of the Cloud and securing above 110.40, which will mean further growth to 111.25.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is trading at 1.0831 under the Ichimoku Cloud, suggesting a downtrend. A test of the lower border of the Cloud at 1.0855 is expected, followed by falling to 1.0710. An additional signal confirming the decline might become a bounce off the upper border of the bearish channel. The scenario can be canceled by a breakaway of the upper border of the Cloud and securing above 1.0895, which will mean further growth to 1.0955. The decline can be confirmed by a breakaway of the lower border of the ascending channel and securing under 1.0775.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair is trading at 0.9249 under the Ichimoku Cloud, suggesting a downtrend. A test of the signal lines of the indicator at 0.9305 is expected, followed by falling to 0.9115. An additional signal confirming the decline might become a bounce off the upper border of the descending channel. The scenario can be canceled by a breakaway of the upper border of the Cloud and securing above 0.9395, which will mean further growth to 0.9485.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.